Your tax-deductible gift supports our music education camps, community engagement initiatives, digital platforms, and our new traditional music and dance educational programs and concerts.

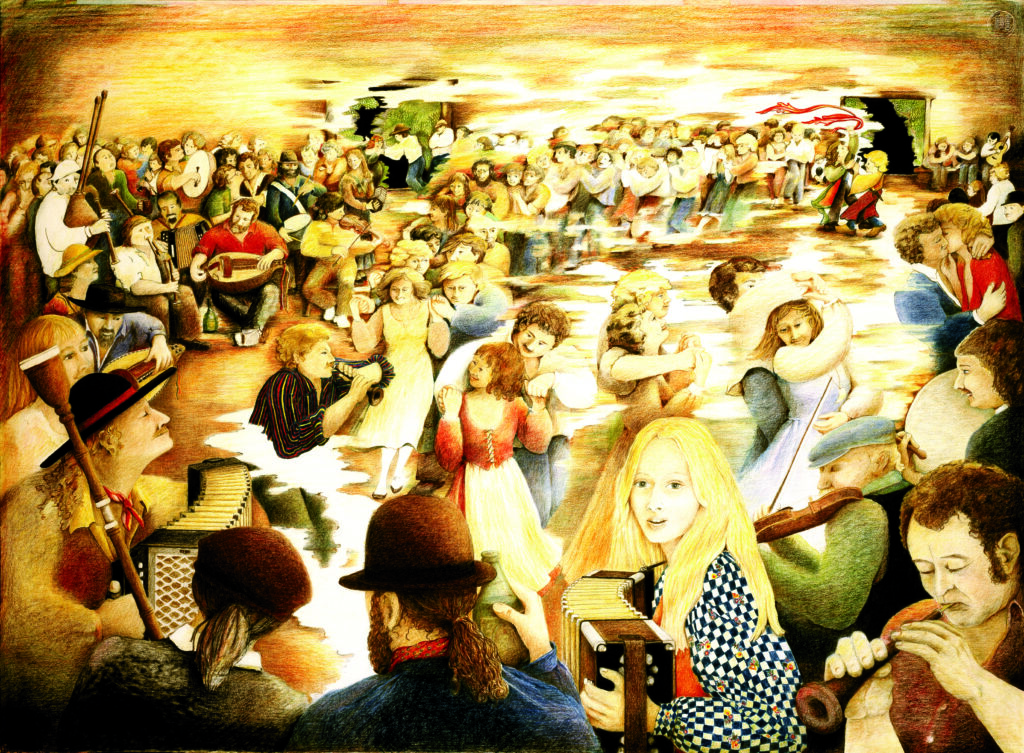

Since 1979, Lark Camp has brought the finest available teachers and performers together to share the joys of music, song, and dance traditions with a growing and increasingly diverse community. Because of our commitment to quality, accessibility, and inclusion, tuition alone does not fully cover the cost of Lark Camp. It never has.

Up until 2018, Lark Camp was a private company, it could subsidize those losses. But now, since becoming a nonprofit in 2019, Lark Camp (Lark Traditional Arts) needs the support of the community, charitable foundations, and donors of all sizes and statures to help us continue serving our mission while negotiating the post-lockdown arts landscape and creating opportunities to expand earned income revenue.

Six years in and we’re going strong.

It is only through the generosity of you—our community of friends and strangers—that LTA and Lark Camp continues to bring top-quality music, song, and dance instruction, performance, and immersion to hundreds of participants every year.

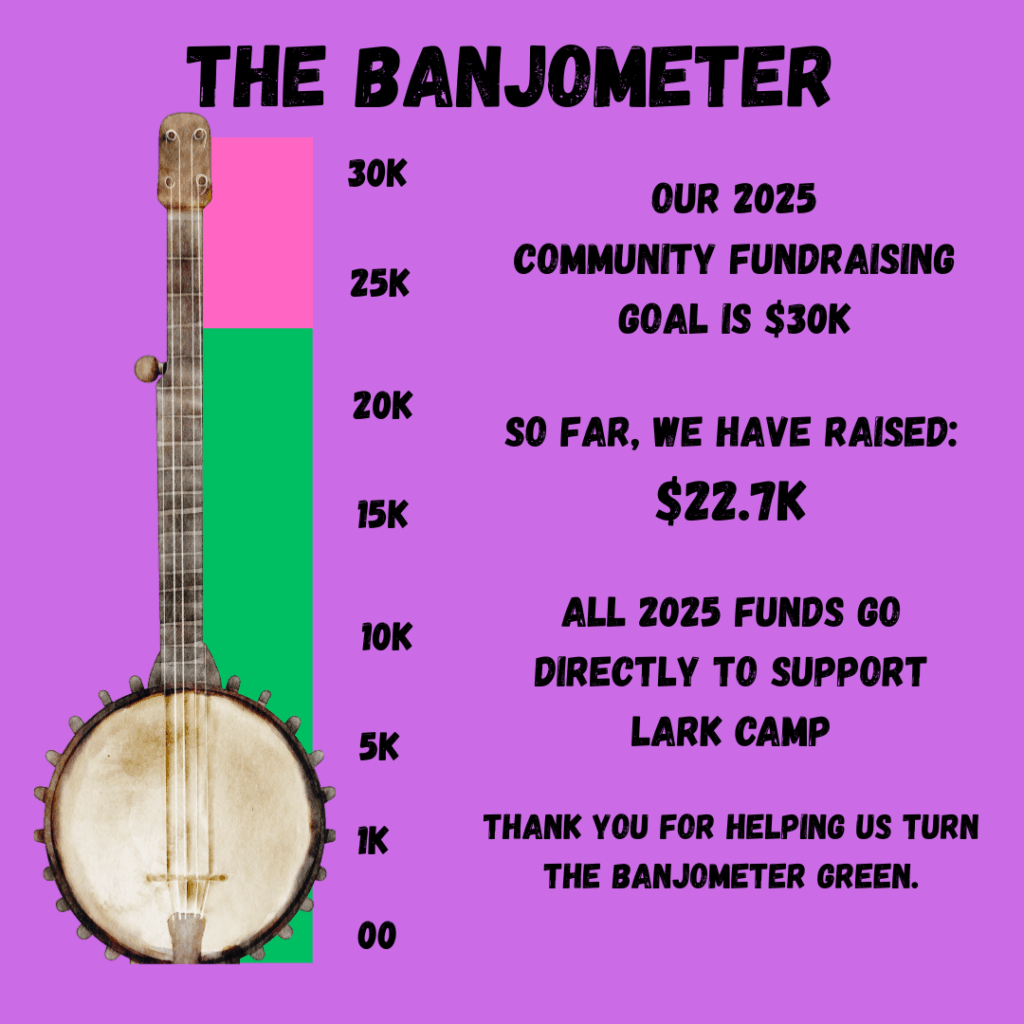

Do your part to turn our FUNDRAISING BANJOMETER green!!

Your gifts, no matter what size or shape, make a difference. And remember, from campsites to jams, from concerts to living rooms. in person or online, we carry the magic and the spirit that creates Lark Camp within us all year round.

As of October, we’re at $22,700. Almost there! Keep it going!

MORE WAYS TO GIVE

Become a part of our community and support us in the way that works best for you. Lark Traditional Arts is a 501(c)(3) non-profit organization, EIN 83-2424940. Thank you for your tax-deductible support in our good works of presenting and preserving traditional music, song, and dance from around the world.

There are several ways you can support LTA. You can:

1. Donate Online real quick right now. Any amount. Thanks!

2. Support LTA with Monthly or Yearly Recurring Donations. Any amount, but the $20 per month is a sweet spot.

3. Mail a check.

Our business name is Lark Traditional Arts. We also do business as Lark Camp. Donation checks may be made payable to either entity. All donations are 100% tax deductible.

Send to:

1726 Carleton St

Berkeley, CA 94703

3. Planned Giving – employer match, donor-advised funds, or Legacy gifts through a Will or Trust

With a planned gift to LTA and Lark Camp, you can combine your joy in giving to a historic multi-cultural charity with your overall financial, tax, and estate planning goals. Planned giving gives you a unique and special connection with Lark Camp. You will help music and dance fill the air and our hearts for now and for years to come.

Employer Match

Many employers match employee contributions to nonprofit charities. Why not boost your gift to Lark Camp/LTA through your company’s charitable fund. Your $10k can become $20k, or $30k.

Gifts from employees’ spouses and retirees may also qualify for a match. Your company may also offer a volunteer grant program, in which companies provide monetary donations to organizations where employees volunteer regularly.

Ask your Human Resources department to find out if your company has a matching gift program. For more information about matching gift donations, contact us at development@larktraditionalarts.org. LTA EIN/Federal Tax ID is 83-2424940.

Donor-Advised Funds

Support LTA and Lark Camp by recommending a grant from your donor-advised fund. For any questions or information on granting donor-advised funds to LTA, please reach out to us at:

development@larktraditionalarts.org

Legacy Giving

By including LTA and Lark Camp in your will or estate plans, you will help inspire and develop future generations of musicians, singers, dancers, and audiences. Many types of assets, in addition to cash, can be used to make a legacy gift. We encourage you to work with your professional advisers and our staff to help you determine which type of legacy gift is best for you.

Charitable Bequests

Your charitable bequest is one of the most important types of gifts for building Lark Camp’s future. When received, your bequest will be recorded as a gift to our annual fund where it will support LTA’s current operating budget.

There are three types of bequests to consider: residual, specific, and/or contingent.

Residual bequests, the most common, are often made after making specific bequests to relatives, friends and charities. Whatever remains after specific bequests (the residuary) can be given in percentage to charity and others.

Specific bequests name a specific entity to give to. Such as, “I give, devise and bequeath to Lark Traditional Arts (LTA), a nonprofit corporation of the State of California, tax ID #83-2424940, located at 1726 Carleton Street, Berkeley, CA, 94703,

Contingent bequests are similar, but say, “In the event of the death of any of the beneficiaries, I give, devise and bequeath to Lark Traditional Arts (LTA), a nonprofit corporation of the State of California, tax ID #83-2424940, located at 1726 Carleton Street, Berkeley, CA, 94703, (specific or residual language as above).”

Let us know about a gift in your will or trust

We want to say thank you for considering our work as a part of your legacy.

It can be difficult to plan and make sure that your gifts are used according to your wishes if they are left unknown. But more importantly, we know that life circumstances can change and you may need to alter or reconsider your gift in the future, so reporting your gift today does not obligate you now nor in the future.

Please reach out to us at development@larktraditionalarts.org or at executive.director@larktraditionalarts.org to speak with us about any legacy gift or charitable bequeathment. We can help you find an answer in tune with your overall plans and wishes.

Donor Bill of Rights

Lark Traditional Arts recognizes that among the ways that we keep the trust of our community and donors is by demonstrating mutuality and respect. In accord with that principle, we subscribe to the practices enumerated in the Donor Bill of Rights, created by leading professional fundraising associations and reproduced here with the permission of the Association of Fundraising Professionals.